规范ialty Silica Market

Market Insights on Specialty Silica covering sales outlook, demand forecast & up-to-date key trends

规范ialty Silica Market By Product Type (Precipitated, Fumed, Fused, Silica Gel, Colloidal), Application (Rubber, Plastic, Ink & Coatings, Electrical & Electronics, Agricultural & Feed, Food & Beverages, Personal Care) & Region - Forecast 2021 - 2031

规范ialty Silica Market Overview

[200 pages Report] The global specialty silica market is anticipated to expand at a CAGR of ~4.8% by during the forecast period of 2021-2031. Specialty silica can be classified into various types such as precipitated, fumed, fused, silica gel and colloidal types.

The demand for specialty silica from various end use industries is growing over the past few years and the growth is expected to continue in next few years on the back of expansion of end-use industries such as rubbers and plastics industries.

Increasing production of tires due to various government regulations; high consumption of consumer goods such as footwear, oral care products; increasing industrial applications, and others are factors expected to drive demand for specialty silica.

规范ialty silica also finds applications in electrical & electronics, personal care, food & beverages, agricultural and feed, inks & coatings amongst others. Eventually, growth in rubber industry leads to remunerative growth in the demand for specialty silica.

In its new study, ESOMAR-certified market research and consulting firm Future Market Insights (FMI) offers insights about key factors driving demand for Specialty Silica Market. The report tracks the global sales of Specialty Silica in 20+ high-growth specialty silica markets, along with analyzing the impact COVID-19 has had on the rubber, plastics, automotive and construction in general, and Specialty Silica in particular.

Let us know your requirement to get

100% FREE customization

How the Historical and Future Outlook of Specialty Silica Market Match Up?

规范ialty silica is used as performance additive in various industries such as rubber and plastics. Inclination towards the use of specialty silica as a performance additives for producing green and energy efficient tires is a key growth driver. Increasing demand from automotive industry owing to its wide range of applications in tire manufacturing including filler material will continue aiding expansion.

Use of specialty silica in tires as a performance additive reduces their rolling resistance and increases road grip in wet weather condition. Furthermore, tire labelling regulations have been being implemented across the globe, further adding the growth for specialty silica.

Leading manufacturers are focusing on developing technologically advanced specialty silica. For instance, Evonik Industries AG, one of the leading manufacturer of specialty silica has recently launch new specialty product Spherilex 145 for the oral care industry. These advancements by specialty silica market participants are expected to be crucial in boosting the demand for specialty silica over the forecast period. According to FMI’s analysis, specialty silica sales is expected to rise at 4.8% CAGR between 2021 and 2031.

With ongoing crisis caused by the COVID-19 pandemic, manufacturing activities have declined. However, are expected to improve with the economic recovery with stabilization of the ongoing pandemic. COVID-19 pandemic has had serious repercussions at various levels on the global economy and on the specialty silica market.

The automotive industry, a key end user of synthetic silica had already reported reduced sales in 2019. COVID-19 outbreak has further impacted the growth of automotive industry, reducing the demand for specialty silica during the pandemic period. Moreover, disruption in supply chain, lack of raw material supply, government lockdowns, and shutdowns impacted the global specialty silica market adversely depleting the growth.

What is the Commercial Potential of Specialty Silica?

规范ialty silica is used in rubber, plastics, ink & coatings, electrical & electronic, agriculture & feed, food & beverages, and personal care industries among others.

特种硅主要用于橡胶、轮胎nd footwear manufacturing, performance additives in tires & plastics, carrier agent in agriculture, chemical mechanical planarization (CMP) in electronics & electrical and others. Specialty silica have wide range of commercial usage and advantages over other materials which is expected to push the specialty silica market in upcoming future.

鳍d your sweet spots for generating winning opportunities in this market.

Talk to AnalystWhat is the Scope for Research and Development (R&D) in Specialty Silica Market?

Some of the major players are investing in R&D to gain a competitive edge. Product development and product positioning strategies are adopted by vendors to build a specialty silica market position. Manufacturers are investing in R&D for developing new products. Also, they are partnering with major end-users to provide customized solutions.

With companies around the world concentrating more on research activities, expansion is expected. Moreover, they are focusing on building sales and service facilities in emerging countries besides forging long term partnerships with regional distributors.

Companies are focusing on advanced product grades. For instance, Solvay is focusing on introducing new grades of highly dispersible silica (HDS) for application in the tire industry. Huber on the other hand is expanding its product portfolio for silica products, for application in the oral care and paper industries.

What is the Regulatory Impact on Usage and Sales of Specialty Silica?

Numerous standards for the manufacturing, handling, and use of specialty silica have been prescribed in Occupational Safety and Health Act of 1970 created by Occupational Safety and Health Administration (OSHA). This organization set a rules of healthful working condition for worker which handling silica.

Furthermore, specialty silica is consumed as a performance additives for producing green and energy efficient tires. With increasing regulations related to tires and carbon emissions, the market for specialty silica is anticipated to spur in foreseeable future.

An unified Market Research Subscription Platform, built for today’s disparate research needs.

How is Focus on Energy-efficiency Driving Specialty Silica Sales?

According to FMI, the increasing focus on green and energy efficient tires is a key trend in the global specialty silica market and is anticipated to drive the specialty silica market. Rubber industry is the most procured area for specialty silica, followed by plastics industry, owing to increasing demand for green tires in automotive vehicles.

Developing value added and high performance grades of specialty silica that deliver superior physical characteristics to end-products and supplying these at competitive prices is among key market strategies adopted by companies. There is immense focus towards developing green processes for producing high grade silica.

For instance, deriving silica from rice husk ash can attract government support as well as help companies gain a competitive edge in terms of end product. Development of new generation products for end use industries is anticipated to give significant impetus to the market.

规范ialty Silica Market Country-wise Insights

What is the Degree of Specialty Silica market Expansion in China?

China is a major manufacturing hub globally for electrical & electronics, rubbers, and other commodities. In China, the demand for specialty silica is growing substantially with rising adoption of green tires in automotive as China is one of the leading automotive vehicles exporter across the globe.

Furthermore, shift in focus of leading manufacturers in automotive industry from Europe to China is projected to impact the specialty silica market positively in the country. Moreover, rapid growth of the personal care industry has created a positive impact on specialty silica demand. This provides tremendous potential for manufacturers of Specialty Silica to introduce new and innovative products in the market.

Which End Use Industries are Exhibiting Demand for Specialty Silica in U.S?

The growth of the rubber and tire industry is creating lucrative opportunity for specialty silica sales in the U.S. Owing to new tire labeling regulations, adoption of green tires is projected to fuel the demand for specialty silica. The plastics industry is also a large consumer of specialty silica, subsequently driving the market in the U.S. Also, with technological advancements in the country, the U.S. is one of the most attractive location for manufacturers.

How Lucrative is the Specialty Silica Market in Germany?

Germany is Europe's largest manufacturer of plastics with an annual turnover of over EUR 101 billion. Specialty silica is used to improve the processing, rheology and overall performance of various plastics, polymer compounds and composites. It is also used as an anti-caking agent, carrier, matting agent etc. in plastics. Owing to this, Germany specialty silica market successively grow in upcoming assessment period. Moreover, the developing automotive, electronics and electrical industry in Germany are creating new opportunities for the growth of specialty silica in the country.

To what extent has Electronics Industry is Driving Specialty Silica Sales in Japan?

Electronics industry in Japan has been the wealthiest and most creative field in the global electronics market for many decades. In the electronics industry, specialty silica finds application in chemical mechanical planarization (CMP) Fumed andcolloidal silicais prominently used for this application. Thus, growth in electronics industry significantly accelerating demand of specialty silica. In addition, Japan's automotive industry is expected to stimulate the market for specialty silica during the forecast period.

What is the demand potential of Specialty Silica in South Korea?

South Korea’s industrial sector contributes 40% to the total GDP. Also, the country is one of the major manufacturing hubs for automotive manufacturers, Original equipment manufacturers (OEMs) and related industries which is expected to create significant demand for specialty silica in the country. Moreover, in South Korea, electronic industry is one of the leading industries and is anticipated to boost the use of specialty silica market, owing to its application in chemical mechanical planarization (CMP) which improve the overall efficiency and productivity of the industry.

规范ialty Silica Market Category-wise Insights

Which Specialty Silica Type will be in High Demand?

Precipitated silicadominated the global specialty silica market and is projected to continue its dominance over forecast period by exhibiting highest growth amongst other types. Growth recorded is attributed to the growing demand from various end use industries such as rubber, plastics, electrical & electronics, personal care, agricultural & feed and others.

Precipitated silica finds its applications as a performance additive in rubber used in production of tire and footwear among others. It is an anti-caking and thickening agent in foods and pharmaceuticals, as a cleaning agent in toothpastes, and flow modifier and anti-foaming agent and others.

Who is Leading End User of Specialty Silica?

橡胶工业预计将主导世界人口l specialty silica market followed by plastics and inks & coatings. Personal care is expected to grow at highest rate owing to increasing consumer spending and increasing concern related to human health amongst the consumers especially in developing countries. Rubber is expected to create the highest opportunity for specialty silica as its falls under high share, high growth category.

规范ialty Silica Market Competitive Landscape

The specialty silica market is significantly competitive. Leading manufacturers are gradually concentrating on positioning innovative technologies to design specialty silica to improve the operating efficiency. Besides this, there is immense focus on strategic collaborations and expanding production capacity.

For instance, in September 2018, Evonik announced that it was planning to expand its production capacity for hydrophobic fumed silica in Rheinfelden, Germany.

Some of the leading companies operating in the market are:

- Solvay SA

- Huber Engineered Materials

- Madhu Silica Pvt. Ltd.

- Evonik Industries AG

- PPG Industries, Inc.

- Akzo Nobel NV

- Cabot Corporation

- Wacker Chemie AG

- Nalco Holding Company

- Qingdao Makall Group Inc.

*The list is not exhaustive, and only for representational purposes. Full competitive intelligence with SWOT analysis available in the report.

Scope of the Report

Attribute |

Details |

Forecast Period |

2021-2031 |

Historical Data Available for |

2016-2020 |

Market Analysis |

USD Million for value and Kilo Tons for Volume |

Key Regions Covered |

North America, Latin America, Europe, East Asia, South Asia & Pacific, Middle East & Africa |

Key Countries Covered |

US, Canada, Germany, U.K., France, Italy, Spain, Russia, China, Japan, South Korea, India, Thailand, Malaysia, Vietnam, Indonesia, Australia, New Zealand, GCC Countries, Turkey, Northern Africa, South Africa |

Key Segments Covered |

By Application, By Product Type, By Application |

Key Companies Profiled |

|

Report Coverage |

Market Forecast, brand share analysis, competition intelligence, DROT analysis, Market Dynamics and Challenges, Strategic Growth Initiatives |

Customization & Pricing |

Enquiry before Buying

Is this research conducted by Future Market Insights?

Yes, the research has been conducted by expert analysts of Future Market Insights through a combination of primary research and secondary research. To know more about how the research was conducted, you canspeak to research analyst

What research methodology is followed by FMI?

FMI follows a methodology that encompasses demand side assessment of the market, and triangulates the same through supply side analysis. This methodology is based on use of standard market structure, methods and definitions.Request detailed methodology

Who are the respondents for primary research?

FMI speaks to stakeholders across the spectrum, including C-level executives, distributors, product manufacturers, industry experts. For a full list of primary respondents, pleasereach outto us.

What are the sources of secondary research?

FMI conducts extensive secondary research through proprietary databases, paid databases, and information available in the public domain. We refer to industry associations, company press releases, annual reports, investor presentations, and research papers. More information about desk research isavailable upon request.

Is a sample of this report available for evaluation?

Yes, you canrequest a sampleand it will be sent to you through an email.

How can I buy this report?

FMI provides a secure online payment system to buy report seamlessly. You canbuy the reportsecurely and safely.

规范ialty Silica Market by Category

By Product Type

- Precipitated

- Fumed

- Fused

- Silica Gel

- Colloidal

By Application

- Rubber

- Plastic

- Ink & Coatings

- Electrical & Electronics

- Agricultural & Feed

- Food & Beverages

- Personal Care

- Others

By Region

- North America

- Latin America

- Europe

- East Asia

- South Asia & Pacific

- Middle East & Africa

Frequently Asked Questions

East Asia currently leads the global Specialty Silica market.

Precipitated and fumed are the most commonly used specialty silica.

规范ialty Silica are widely used in rubber industry. Also its usage in plastics, ink & coatings is increasing day-by-day.

Some of the leading companies manufacturing Specialty Silica are Solvay SA, Huber Engineered Materials, Madhu Silica Pvt. Ltd., Evonik Industries AG, PPG Industries, Inc., Akzo Nobel NV, Cabot Corporation, Wacker Chemie AG, etc.

Precipitated silica is the driving sales of specialty silica owing to its wide applications in manufacturing of rubber and tire.

1. Executive Summary

1.1. Global Market Outlook

1.2. Demand Side Trends

1.3. Supply Side Trends

1.4. Analysis and Recommendations

2. Market Overview

2.1. Market Coverage / Taxonomy

2.2. Market Definition / Scope / Limitations

3. Key Market Trends

3.1. Key Trends Impacting the Market

3.2. Product Innovation / Development Trends

4. Key Success Factors

4.1. Product Adoption / Usage Analysis

4.2. Strategic Promotional Strategies

5. Global Specialty Silica Market Demand Analysis 2016-2020 and Forecast, 2021-2031

5.1. Historical Market Volume (Kilo Tons) Analysis, 2016-2020

5.2.当前和未来的市场容量(公斤吨)Projections, 2021-2031

5.3. Y-o-Y Growth Trend Analysis

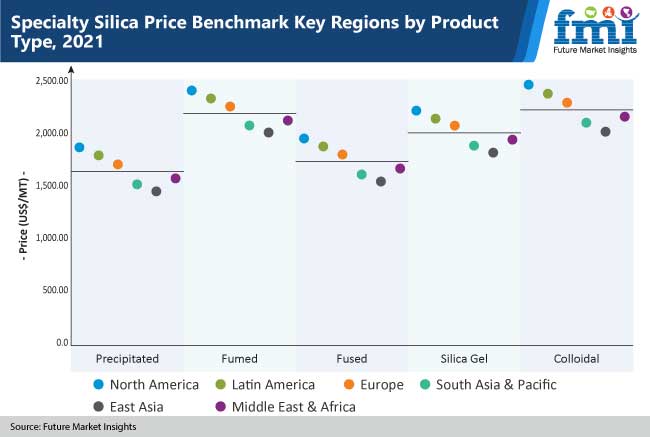

6. Global Specialty Silica Market - Pricing Analysis

6.1.区域产品类型的定价分析

6.2. Pricing Break-up

6.3. Global Average Pricing Analysis Benchmark

7. Global Specialty Silica Market Demand (in Value or Size in US$ Mn) Analysis 2016-2020 and Forecast, 2021-2031

7.1. Historical Market Value (US$ Mn) Analysis, 2016-2020

7.2. Current and Future Market Value (US$ Mn) Projections, 2021-2031

7.2.1. Y-o-Y Growth Trend Analysis

7.2.2. Absolute $ Opportunity Analysis

8. Market Background

8.1. Macro-Economic Factors

8.2. Forecast Factors - Relevance & Impact

8.3. Value Chain

8.3.1. List of Raw Material Manufacturers

8.3.2. List of Specialty Silica Manufacturers

8.3.3. List of Distributors/ Suppliers

8.3.4. Profitability Margin

8.4. Market Dynamics

8.4.1. Drivers

8.4.2. Restraints

8.4.3. Opportunity Analysis

8.5. Cost Structure Analysis

8.6. Covid-19 Impact Assessment

9. Global Specialty Silica Market Analysis 2016-2020 and Forecast 2021-2031, by Product Type

9.1. Introduction / Key Findings

9.2. Historical Market Size (US$ Mn) and Volume Analysis By Product Type, 2015 - 2019

9.3. Current and Future Market Size (US$ Mn) and Volume Analysis and Forecast By Product Type, 2020 - 2030

9.3.1.1. Precipitated

9.3.1.2. Fumed

9.3.1.3. Fused

9.3.1.4. Silica Gel

9.3.1.5. Colloidal

9.4. Market Attractiveness Analysis By Product Type

10. Global Specialty Silica Market Analysis 2016-2020 and Forecast 2021-2031, by Application

10.1. Introduction / Key Findings

10.2. Historical Market Size (US$ Mn) and Volume Analysis By Application, 2015 - 2019

10.3. Current and Future Market Size (US$ Mn) and Volume Analysis and Forecast By Application, 2020 - 2030

10.3.1. Rubber

10.3.2. Plastics

10.3.3. Ink & Coatings

10.3.4. Electrical & Electronics

10.3.5. Agriculture & Feed

10.3.6. Food & Beverage

10.3.7. Personal Care

10.3.8. Others

10.4. Market Attractiveness Analysis By Application

11. Global Specialty Silica Market Analysis 2016-2020 and Forecast 2021-2031, by Region

11.1. Introduction

11.2. Historical Market Size (US$ Mn) and Volume Analysis By Region, 2015 - 2019

11.3. Current Market Size (US$ Mn) and Volume Analysis and Forecast By Region, 2020 - 2030

11.3.1. North America

11.3.2. Latin America

11.3.3. Europe

11.3.4. East Asia

11.3.5. South Asia &Pacific

11.3.6. Middle East and Africa (MEA)

11.4. Market Attractiveness Analysis By Region

12. North America Specialty Silica Market Analysis 2016-2020 and Forecast 2021-2031

12.1. Introduction

12.2. Pricing Analysis

12.3. Historical Market Size (US$ Mn) and Volume Trend Analysis By Market Taxonomy, 2015 - 2019

12.4. Market Size (US$ Mn) and Volume Forecast By Market Taxonomy, 2020 - 2030

12.4.1. By Country

12.4.1.1. U.S.

12.4.1.2. Canada

12.4.2. By Product Type

12.4.3. By Application

12.5. Market Attractiveness Analysis

12.5.1.按国家

12.5.2. By Product Type

12.5.3. By Application

12.6. Market Trends

12.7. Drivers and Restraints - Impact Analysis

13. Latin America Specialty Silica Market Analysis 2016-2020 and Forecast 2021-2031

13.1. Introduction

13.2. Pricing Analysis

13.3. Historical Market Size (US$ Mn) and Volume Trend Analysis By Market Taxonomy, 2015 - 2019

13.4. Market Size (US$ Mn) and Volume Forecast By Market Taxonomy, 2020 - 2030

13.4.1. By Country

13.4.1.1. Brazil

13.4.1.2. Mexico

13.4.1.3. Rest of Latin America

13.4.2. By Product Type

13.4.3. By Application

13.5. Market Attractiveness Analysis

13.5.1. By Country

13.5.2. By Product Type

13.5.3. By Application

13.6. Market Trends

13.7. Drivers and Restraints - Impact Analysis

14. Europe Specialty Silica Market Analysis 2016-2020 and Forecast 2021-2031

14.1. Introduction

14.2. Pricing Analysis

14.3. Historical Market Size (US$ Mn) and Volume Trend Analysis By Market Taxonomy, 2015 - 2019

14.4. Market Size (US$ Mn) and Volume Forecast By Market Taxonomy, 2020 - 2030

14.4.1. By Country

14.4.1.1. Germany

14.4.1.2. Italy

14.4.1.3. France

14.4.1.4. U.K.

14.4.1.5. Spain

14.4.1.6. Russia

14.4.1.7. Rest of Europe

14.4.2. By Product Type

14.4.3. By Application

14.5. Market Attractiveness Analysis

14.5.1. By Country

14.5.2. By Product Type

14.5.3. By Application

14.6. Market Trends

14.7. Drivers and Restraints - Impact Analysis

15. East Asia Specialty Silica Market Analysis 2016-2020 and Forecast 2021-2031

15.1. Introduction

15.2. Pricing Analysis

15.3. Historical Market Size (US$ Mn) and Volume Trend Analysis By Market Taxonomy, 2015 - 2019

15.4. Market Size (US$ Mn) and Volume Forecast By Market Taxonomy, 2020 - 2030

15.4.1. By Country

15.4.1.1. China

15.4.1.2. Japan

15.4.1.3. South Korea

15.4.2. By Product Type

15.4.3. By Application

15.5. Market Attractiveness Analysis

15.5.1. By Country

15.5.2. By Product Type

15.5.3. By Application

15.6. Market Trends

15.7. Drivers and Restraints - Impact Analysis

16. South Asia & Pacific Specialty Silica Market Analysis 2016-2020 and Forecast 2021-2031

16.1. Introduction

16.2. Pricing Analysis

16.3. Historical Market Size (US$ Mn) and Volume Trend Analysis By Market Taxonomy, 2015 - 2019

16.4. Market Size (US$ Mn) and Volume Forecast By Market Taxonomy, 2020 - 2030

16.4.1. By Country

16.4.1.1. India

16.4.1.2. ASEAN

16.4.1.3. Oceania

16.4.1.4. Rest of Asia Pacific

16.4.2. By Product Type

16.4.3. By Application

16.5. Market Attractiveness Analysis

16.5.1. By Country

16.5.2. By Product Type

16.5.3. By Application

16.6. Market Trends

16.7. Drivers and Restraints - Impact Analysis

17. Middle East and Africa Specialty Silica Market Analysis 2016-2020 and Forecast 2021-2031

17.1. Introduction

17.2. Pricing Analysis

17.3. Historical Market Size (US$ Mn) and Volume Trend Analysis By Market Taxonomy, 2015 - 2019

17.4. Market Size (US$ Mn) and Volume Forecast By Market Taxonomy, 2020 - 2030

17.4.1. By Country

17.4.1.1. GCC Countries

17.4.1.2. South Africa

17.4.1.3. Northern Africa

17.4.1.4. Rest of Middle East and Africa

17.4.2. By Product Type

17.4.3. By Application

17.5. Market Attractiveness Analysis

17.5.1. By Country

17.5.2. By Product Type

17.5.3. By Application

17.6. Market Trends

17.7. Drivers and Restraints - Impact Analysis

18. Key and Emerging Countries Specialty Silica Market Analysis

18.1. U.S. Specialty Silica Market Analysis

18.1.1. By Product Type

18.1.2. By Application

18.2. Canada Specialty Silica Market Analysis

18.2.1. By Product Type

18.2.2. By Application

18.3. Mexico Specialty Silica Market Analysis

18.3.1. By Product Type

18.3.2. By Application

18.4. Brazil Specialty Silica Market Analysis

18.4.1. By Product Type

18.4.2. By Application

18.5. Germany Specialty Silica Market Analysis

18.5.1. By Product Type

18.5.2. By Application

18.6. Italy Specialty Silica Market Analysis

18.6.1. By Product Type

18.6.2. By Application

18.7. France Specialty Silica Market Analysis

18.7.1. By Product Type

18.7.2. By Application

18.8. U.K. Specialty Silica Market Analysis

18.8.1. By Product Type

18.8.2. By Application

18.9. Spain Specialty Silica Market Analysis

18.9.1. By Product Type

18.9.2. By Application

18.10. Russia Specialty Silica Market Analysis

18.10.1. By Product Type

18.10.2. By Application

18.11. China Specialty Silica Market Analysis

18.11.1. By Product Type

18.11.2. By Application

18.12. Japan Specialty Silica Market Analysis

18.12.1. By Product Type

18.12.2. By Application

18.13. South Korea Specialty Silica Market Analysis

18.13.1. By Product Type

18.13.2. By Application

18.14. ASEAN Specialty Silica Market Analysis

18.14.1. By Product Type

18.14.2. By Application

18.15.印度特种硅市场分析

18.15.1. By Product Type

18.16. By Application Oceania Specialty Silica Market Analysis

18.16.1. By Product Type

18.16.2. By Application

18.17. GCC Countries Specialty Silica Market Analysis

18.17.1. By Product Type

18.17.2. By Application

18.18.南非专业硅市场分析is

18.18.1. By Product Type

18.18.2. By Application

19. Market Structure Analysis

19.1. Market Analysis by Tier of Companies (Specialty Silica)

19.2. Market Concentration

19.3. Market Share Analysis of Top Players

19.4. Market Presence Analysis

19.4.1. By Regional footprint of Players

19.4.2. Product foot print by Players

19.4.3. Channel Foot Print by Players

20. Competition Analysis

20.1. Competition Dashboard

20.2. Pricing Analysis by Competition

20.3. Competition Benchmarking

20.4. Competition Deep Dive

20.4.1. Solvay SA

20.4.1.1. Overview

20.4.1.2. Product Portfolio

20.4.1.3. Profitability by Market Segments (Product/Channel/Region)

20.4.1.4. Sales Footprint

20.4.1.5. Strategy Overview

20.4.2. Huber Engineered Materials

20.4.2.1. Overview

20.4.2.2. Product Portfolio

20.4.2.3. Profitability by Market Segments (Product/Channel/Region)

20.4.2.4. Sales Footprint

20.4.2.5. Strategy Overview

20.4.3. Madhu Silica Pvt. Ltd.

20.4.3.1. Overview

20.4.3.2. Product Portfolio

20.4.3.3. Profitability by Market Segments (Product/Channel/Region)

20.4.3.4. Sales Footprint

20.4.3.5. Strategy Overview

20.4.4. Evonik Industries AG

20.4.4.1. Overview

20.4.4.2. Product Portfolio

20.4.4.3. Profitability by Market Segments (Product/Channel/Region)

20.4.4.4. Sales Footprint

20.4.4.5. Strategy Overview

20.4.5. PPG Industries, Inc.

20.4.5.1. Overview

20.4.5.2. Product Portfolio

20.4.5.3. Profitability by Market Segments (Product/Channel/Region)

20.4.5.4. Sales Footprint

20.4.5.5. Strategy Overview

20.4.6. Akzo Nobel NV

20.4.6.1. Overview

20.4.6.2. Product Portfolio

20.4.6.3. Profitability by Market Segments (Product/Channel/Region)

20.4.6.4. Sales Footprint

20.4.6.5. Strategy Overview

20.4.7. Cabot Corporation

20.4.7.1. Overview

20.4.7.2. Product Portfolio

20.4.7.3. Profitability by Market Segments (Product/Channel/Region)

20.4.7.4. Sales Footprint

20.4.7.5. Strategy Overview

20.4.8. Wacker Chemie AG

20.4.8.1. Overview

20.4.8.2. Product Portfolio

20.4.8.3. Profitability by Market Segments (Product/Channel/Region)

20.4.8.4. Sales Footprint

20.4.8.5. Strategy Overview

20.4.9. Nalco Holding Company

20.4.9.1. Overview

20.4.9.2. Product Portfolio

20.4.9.3. Profitability by Market Segments (Product/Channel/Region)

20.4.9.4. Sales Footprint

20.4.9.5. Strategy Overview

20.4.10. Qingdao Makall Group Inc.

20.4.10.1. Overview

20.4.10.2. Product Portfolio

20.4.10.3. Profitability by Market Segments (Product/Channel/Region)

20.4.10.4. Sales Footprint

20.4.10.5. Strategy Overview

21. Assumptions and Acronyms Used

22. Research Methodology

Let us know your requirement to get

100% FREE customization

Table 01: Global Specialty Silica Market Size (US$ Mn) and Volume (KT) Forecast by Product, 2016–2031

Table 02: Global Specialty Silica Market Size (US$ Mn) by Application, 2016–2031

Table 03: Global Specialty Silica Volume (KT) Forecast by Application, 2016–2031

Table 04: Global Specialty Silica Market Size (US$ Mn) and Volume (KT) Forecast by Region, 2016–2031

Table 05: North America Specialty Silica Size (US$ Mn) and Volume (KT) Forecast by Country, 2016–2031

Table 06: North America Specialty Silica Size Volume (KT) and Value (US$ Mn) Forecast by Product Type, 2015–2030

Table 07: North America Specialty Silica Market Size (US$ Mn) by Application, 2016–2031

Table 08: North America Specialty Silica Volume (KT) Forecast by Application, 2016–2031

Table 09: Latin America Specialty Silica Size (US$ Mn) and Volume (KT) Forecast by Country, 2016–2031

Table 10: Latin America Specialty Silica Size Volume (KT) and Value (US$ Mn) Forecast by Product Type, 2015–2030

Table 11: Latin America Specialty Silica Market Size (US$ Mn) by Application, 2016–2031

Table 12: Latin America Specialty Silica Volume (KT) Forecast by Application, 2016–2031

Table 13: Europe Specialty Silica Volume (KT) Forecast by Country, 2016–2031

Table 14: Europe Specialty Silica Value (US$ Mn) Forecast by Country, 2016–2031

Table 15: Europe Specialty Silica Size Volume (KT) and Value (US$ Mn) Forecast by Product Type, 2015–2030

Table 16: Europe Specialty Silica Market Size (US$ Mn) by Application, 2016–2031

Table 17: Europe Specialty Silica Volume (KT) Forecast by Application, 2016–2031

Table 18: East Asia Specialty Silica Size (US$ Mn) and Volume (KT) Forecast by Country, 2016–2031

Table 19: East Asia Specialty Silica Size Volume (KT) and Value (US$ Mn) Forecast by Product Type, 2015–2030

Table 20: East Asia Specialty Silica Market Size (US$ Mn) by Application, 2016–2031

Table 21: East Asia Specialty Silica Volume (KT) Forecast by Application, 2016–2031

Table 22: South Asia & Pacific Specialty Silica Size (US$ Mn) and Volume (KT) Forecast by Country, 2016–2031

Table 23: South Asia & Pacific Specialty Silica Size Volume (KT) and Value (US$ Mn) Forecast by Product Type, 2015–2030

Table 24: South Asia & Pacific Specialty Silica Market Size (US$ Mn) by Application, 2016–2031

Table 25: South Asia & Pacific Specialty Silica Volume (KT) Forecast by Application, 2016–2031

Table 26: MEA Specialty Silica Size (US$ Mn) and Volume (KT) Forecast by Country, 2016–2031

Table 27: MEA Specialty Silica Size Volume (KT) and Value (US$ Mn) Forecast by Product Type, 2015–2030

Table 28: MEA Specialty Silica Market Size (US$ Mn) by Application, 2016–2031

Table 29: MEA Specialty Silica Volume (KT) Forecast by Application, 2016–2031

鳍d your sweet spots for generating winning opportunities in this market.

Talk to AnalystFigure 01: Global Specialty Silica Market Volume Share by Product, 2021

Figure 02: Global Specialty Silica Market Volume Share by Product, 2031

Figure 03: Global Specialty Silica Market Share and BPS Analysis by Product– 2021 & 2031

Figure 04: Global Specialty Silica Market Y-o-Y Growth Projections by Product, 2021 - 2031

Figure 05: Global Specialty Silica Market Absolute $ Opportunity by Precipitated Segment

Figure 06: Global Specialty Silica Market Absolute $ Opportunity by Fumed Segment

Figure 07: Global Specialty Silica Market Absolute $ Opportunity by Fused Segment

Figure 08: Global Specialty Silica Market Absolute $ Opportunity by Silica Gel Segment

Figure 09: Global Specialty Silica Market Absolute $ Opportunity by Colloidal Segment

Figure 10: Global Specialty Silica Market Attractiveness Analysis by Product, 2021-2031

Figure 11: Global Specialty Silica Market Volume Share by Application, 2021

Figure 12: Global Specialty Silica Volume Share by Application, 2031

Figure 13: Global Specialty Silica Market Share and BPS Analysis by Application– 2021 & 2031

Figure 14: Global Specialty Silica Market Y-o-Y Growth Projections by Application, 2021 – 2031

Figure 15: Global Specialty Silica Market Absolute $ Opportunity by Rubber Segment

Figure 16: Global Specialty Silica Market Absolute $ Opportunity by Plastics Segment

Figure 17: Global Specialty Silica Market Absolute $ Opportunity by Ink & Coatings Segment

Figure 18: Global Specialty Silica Market Absolute $ Opportunity by Electrical & Electronics Segment

Figure 19: Global Specialty Silica Market Absolute $ Opportunity by Agriculture & Feed Segment

Figure 20: Global Specialty Silica Market Absolute $ Opportunity by Food & Beverage Segment

Figure 21: Global Specialty Silica Market Absolute $ Opportunity by Personal Care Segment

Figure 22: Global Specialty Silica Market Absolute $ Opportunity by Others Segment

Figure 23: Global Specialty Silica Market Attractiveness Analysis by Application , 2021-2031

Figure 24: Global Specialty Silica Market Volume Share by Region, 2021

Figure 25: Global Specialty Silica Market Volume Share by Region, 2031

Figure 26: Global Specialty Silica Market Share and BPS Analysis by Region– 2021 & 2031

Figure 27: Global Specialty Silica Market Y-o-Y Growth Projections by Region, 2021 – 2031

Figure 28: Global Specialty Silica Market Absolute $ Opportunity by North America Region

Figure 29: Global Specialty Silica Market Absolute $ Opportunity by Latin America Region

Figure 30: Global Specialty Silica Market Absolute $ Opportunity by Europe Region

Figure 31: Global Specialty Silica Market Absolute $ Opportunity by South Asia Pacific Region

Figure 32: Global Specialty Silica Market Absolute $ Opportunity by East Asia Region

Figure 33: Global Specialty Silica Market Absolute $ Opportunity by MEA Region

Figure 34: Global Specialty Silica Market Attractiveness Analysis by Region, 2021-2031

Figure 35: North America Specialty Silica Share and BPS Analysis by Country– 2021 & 2031

Figure 36: North America Specialty Silica Y-o-Y Growth Projections by Country, 2021 – 2031

Figure 37: North America Specialty Silica Attractiveness Analysis by Country, 2021-2031

Figure 38: North America Specialty Silica Absolute $ Opportunity by U.S. Segment

Figure 39: North America Specialty Silica Absolute $ Opportunity by Canada Segment

Figure 40: North America Specialty Silica Share and BPS Analysis by Product Type– 2021 & 2031

图41:北美种社会lty Silica Y-o-Y Growth Projections by Product Type, 2021 – 2031

Figure 42: North America Specialty Silica attractiveness Analysis by Product Type, 2021-2031

Figure 43: North America Specialty Silica Share and BPS Analysis by Application– 2021 & 2031

Figure 44: North America Specialty Silica Y-o-Y Growth Projections by Application, 2021 – 2031

Figure 45: North America Specialty Silica attractiveness Analysis by Product Type, 2021-2031

Figure 46: Latin America Specialty Silica Share and BPS Analysis by Country– 2021 & 2031

Figure 47: Latin America Specialty Silica Y-o-Y Growth Projections by Country, 2021 - 2031

Figure 48: Latin America Specialty Silica Attractiveness Analysis by Country, 2021-2031

Figure 49: Latin America Specialty Silica Absolute $ Opportunity by Mexico Segment

Figure 50: Latin America Specialty Silica Absolute $ Opportunity by Brazil Segment

Figure 51: Latin America Specialty Silica Absolute $ Opportunity by Rest of Latin America Segment

Figure 52: Latin America Specialty Silica Share and BPS Analysis by Product Type– 2021 & 2031

Figure 53: Latin America Specialty Silica Y-o-Y Growth Projections by Product Type, 2021 – 2031

Figure 54: Latin America Specialty Silica attractiveness Analysis by Product Type, 2021-2031

Figure 55: Latin America Specialty Silica Share and BPS Analysis by Application– 2021 & 2031

Figure 56: Latin America Specialty Silica Y-o-Y Growth Projections by Application, 2021 – 2031

Figure 57: Latin America Specialty Silica attractiveness Analysis by Product Type, 2021-2031

Figure 58: Europe Specialty Silica Share and BPS Analysis by Country– 2021 & 2031

Figure 59: Europe Specialty Silica Y-o-Y Growth Projections by Country, 2021 – 2031

Figure 60: Europe Specialty Silica Attractiveness Analysis by Country, 2021-2031

Figure 61: Europe Specialty Silica Absolute $ Opportunity by Germany Segment

Figure 62: Europe Specialty Silica Absolute $ Opportunity by Italy Segment

Figure 63: Europe Specialty Silica Absolute $ Opportunity by France Segment

Figure 64: Europe Specialty Silica Absolute $ Opportunity by U.K Segment

Figure 65: Europe Specialty Silica Absolute $ Opportunity by Spain Segment

Figure 66: Europe Specialty Silica Absolute $ Opportunity by Russia Segment

Figure 67: Europe Specialty Silica Absolute $ Opportunity by Russia Segment

Figure 68: Europe Specialty Silica Share and BPS Analysis by Product Type– 2021 & 2031

Figure 69: Europe Specialty Silica Y-o-Y Growth Projections by Product Type, 2021 – 2031

Figure 70: Europe Specialty Silica attractiveness Analysis by Product Type, 2021-2031

Figure 71: Europe Specialty Silica Share and BPS Analysis by Application– 2021 & 2031

Figure 72: Europe Specialty Silica Y-o-Y Growth Projections by Application, 2021 – 2031

Figure 73: Europe Specialty Silica attractiveness Analysis by Product Type, 2021-2031

Figure 74: East Asia Specialty Silica Share and BPS Analysis by Country– 2021 & 2031

Figure 75: East Asia Specialty Silica Y-o-Y Growth Projections by Country, 2021 – 2031

Figure 76: East Asia Specialty Silica Attractiveness Analysis by Country, 2021-2031

Figure 77: East Asia Specialty Silica Absolute $ Opportunity by China Segment

Figure 78: East Asia Specialty Silica Absolute $ Opportunity by Japan Segment

Figure 79: East Asia Specialty Silica Absolute $ Opportunity by South Korea Segment

Figure 80: East Asia Specialty Silica Share and BPS Analysis by Product Type– 2021 & 2031

Figure 81: East Asia Specialty Silica Y-o-Y Growth Projections by Product Type, 2021 – 2031

Figure 82: East Asia Specialty Silica attractiveness Analysis by Product Type, 2021-2031

Figure 83: East Asia Specialty Silica Share and BPS Analysis by Application– 2021 & 2031

Figure 84: East Asia Specialty Silica Y-o-Y Growth Projections by Application, 2021 – 2031

Figure 85: East Asia Specialty Silica attractiveness Analysis by Product Type, 2021-2031

Figure 86: South Asia & Pacific Specialty Silica Share and BPS Analysis by Country– 2021 & 2031

Figure 87: South Asia & Pacific Specialty Silica Y-o-Y Growth Projections by Country, 2021 – 2031

Figure 88: South Asia & Pacific Specialty Silica Attractiveness Analysis by Country, 2021-2031

Figure 89: South Asia & Pacific Specialty Silica Absolute $ Opportunity by India Segment

Figure 90: South Asia & Pacific Specialty Silica Absolute $ Opportunity by ASEAN Segment

Figure 91: South Asia & Pacific Specialty Silica Absolute $ Opportunity by Oceania Segment

Figure 92: South Asia & Pacific Specialty Silica Absolute $ Opportunity by Rest of SAP Segment

Figure 93: South Asia & Pacific Specialty Silica Share and BPS Analysis by Product Type– 2021 & 2031

Figure 94: South Asia & Pacific Specialty Silica Y-o-Y Growth Projections by Product Type, 2021 – 2031

图95:南亚及太平洋特种二氧化硅ttractiveness Analysis by Product Type, 2021-2031

Figure 96: South Asia & Pacific Specialty Silica Share and BPS Analysis by Application– 2021 & 2031

Figure 97: South Asia & Pacific Specialty Silica Y-o-Y Growth Projections by Application, 2021 – 2031

Figure 98: South Asia & Pacific Specialty Silica attractiveness Analysis by Product Type, 2021-2031

Figure 99: MEA Specialty Silica Share and BPS Analysis by Country– 2021 & 2031

Figure 100: MEA Specialty Silica Y-o-Y Growth Projections by Country, 2021 – 2031

Figure 101: MEA Specialty Silica Attractiveness Analysis by Country, 2021-2031

Figure 102: MEA Specialty Silica Absolute $ Opportunity by GCC Countries Segment

Figure 103: MEA Specialty Silica Absolute $ Opportunity by Turkey Segment

Figure 104: MEA Specialty Silica Absolute $ Opportunity by Northern Africa Segment

Figure 105: MEA Specialty Silica Absolute $ Opportunity by South Africa Segment

图106:意味着专业硅绝对Opport美元unity by Rest of MEA Segment

Figure 107: MEA Specialty Silica Share and BPS Analysis by Product Type– 2021 & 2031

Figure 108: MEA Specialty Silica Y-o-Y Growth Projections by Product Type, 2021 – 2031

Figure 109: MEA Specialty Silica attractiveness Analysis by Product Type, 2021-2031

Figure 110: MEA Specialty Silica Share and BPS Analysis by Application– 2021 & 2031

Figure 111: MEA Specialty Silica Y-o-Y Growth Projections by Application, 2021 – 2031

Figure 112: MEA Specialty Silica attractiveness Analysis by Product Type, 2021-2031

Need specific information?

Request CustomizationExplore Chemicals & Materials Insights

View Reports